It was once said that the stock market has forecasted nine of the last five recessions. While humorously conveying the point that the prediction game is fraught with potential missteps, this adage also underscores a sobering truth: At some point, every investor must grapple with a downturn or even a full-blown crash. However, with foresight, knowledge, and strategy, a crashing market can be valuable opportunities to fortify your investment strategy. In this article, we'll delve into stock market crash preparation, investigate what actions to take before a stock market crash, and present strategies to handle stock market crashes.

The Bull, the Bear, and You: Understanding Stock Market Cycles

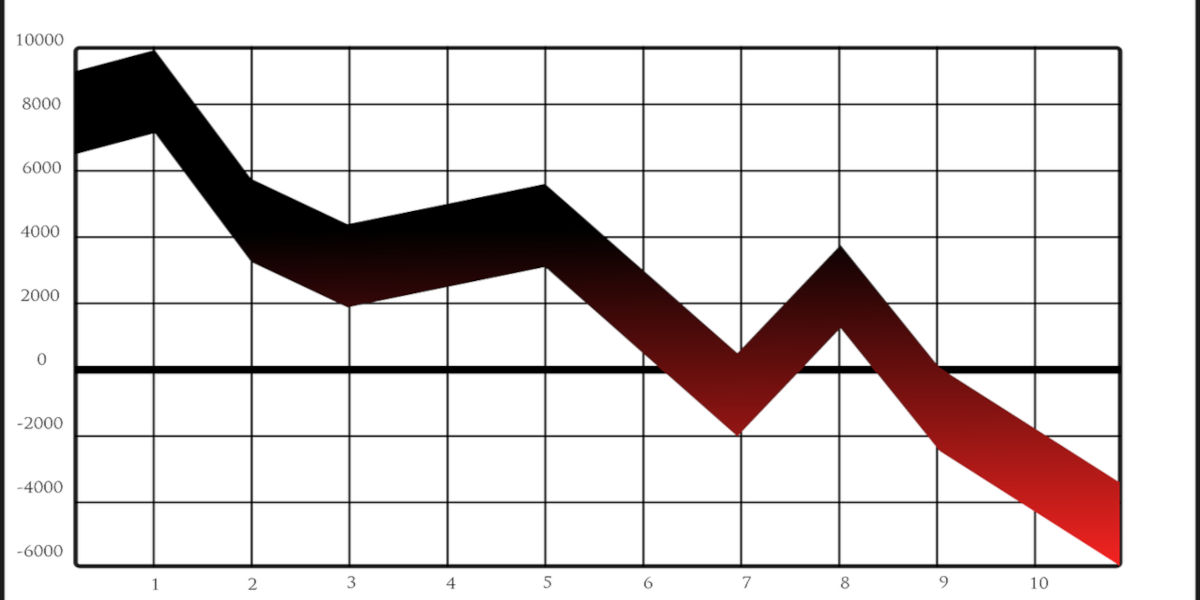

Critical to preparing for a stock market crash is understanding stock market cycles. In essence, the stock market follows a long-standing pattern of peaks (bull markets) and troughs (bear markets). Identifying where you are in the cycle can provide critical insights into potential market downturns.

A bull market is symbolized by surging stock prices and optimism among investors. It's an investor's paradise, where profits are easy to come by, and the stock market appears to be a source of never-ending wealth. Conversely, a bear market is epitomized by falling stock prices and widespread pessimism. It is in these times that investors often panic, hastily selling off their stocks to cut losses, thereby exacerbating the crisis.

However, the cycle of the market is precisely that, cyclical - the bull always follows the bear, and the opposite is also true. This cyclical nature is where smart investors can leverage their knowledge of the market cycles and stand firm in the face of a potential crash, ready to seize golden investment opportunities as they arise.

What Should I Do Before a Stock Market Crash?

The most effective stock market crash preparation begins well before any signs of a downturn. To begin with, focus on sound investment principles: diversification, long-term outlook, and regular investing.

Diversification is an absolute must for any prudent investor. It's all about spreading your risks across different assets, sectors, or geographical regions. As the old adage goes, it's not wise to put all your eggs in one basket. When one sector or asset class experiences a downturn, other investments in your portfolio might flourish, thus reducing your overall risk.

Next, holding a long-term outlook is vital. It's well documented that over the long haul, the stock market increases in value, despite short-term volatility. A crash, while significant in near-term, often fades into insignificance over the course of an extended investment horizon.

Lastly, regular investing – specifically, a strategy known as dollar-cost averaging – can work wonders. By regularly investing the same amount of money, you'll buy more shares when prices are low and fewer when they're high, reducing your average cost per share over time.

Establishing Strategies to Handle Stock Market Crashes

As a crucial part of your stock market crash preparation, establishing strategies to handle these occasional but inevitable events is vital. While the principles mentioned above will serve as a solid foundation, specific strategies can help you navigate market turbulence more effectively.

When there's a forecast of a storm, people start preparing. They stock up on essentials, protect their homes and assure their safety. Similarly, a stock market crash is a storm in its own right - a financial storm! Banking on their instincts, intelligent investors have got through market downturns by preparing and strategizing. There's no reason why you can't do the same. Here's how:

Develop a Well-balanced Portfolio

Building a diverse portfolio can act as a buffer against stock market crashes. While high-profit investments can be attractive, balancing them with safer, lower-yielding investments can protect you from severe market drops. Sprawling your investments across a variety of industries and sectors, will reduce the risk of your total portfolio taking a hit due to the fall in a particular sector.

Ensure that you incorporate a blend of stocks, bonds, mutual funds, and real estate in your investment portfolio. Each of these asset types behaves differently in response to market fluctuations. This variance will work in your favor when the times are tough in one market.

Invest for the Long Term

One mantra that has always been fruitful in the investing world is thinking long-term. Although stock market crashes lead to drastic drops, historically, the economy has always managed to recover over time. Patience, then, becomes a key component of your strategy. Resist the urge to sell when prices plummet, this might lock in your losses.

Holding on to your investments even during a decline, and then waiting for the markets to have an upward swing, allows you to regain any potential losses that might have occurred. Bear in mind, this requires courage and a deep understanding of the stock market trends.

Avoid Panic Selling

Panic selling is a common investor behavior during a stock market crash. It is the result of fear taking over rational decisions, leading to the disposal of all stocks at the fear of further decline. Unfortunately, this impulsive move mostly ends up in regret.

Remember that stock prices are a reflection of the company's future earning power and not the current economic scenario. Hence, unless the fundamental characteristics of your stocks have changed, remain calm and avoid panic selling.

Have an Emergency Fund

Having a stock market investment means embracing risk; and the best way to handle risk is preparation. A well-stocked emergency fund provides a safety net during turbulent times. It will fend off the need to sell off investments at a loss due to financial urgency.

You can continue investing without worry, secure in the knowledge that you have a financial buffer to fall back on. Aim for an emergency fund that can cover 3-6 months of living expenses to mitigate any unforeseen hit.

In conclusion, preparation and strategy can make you weather any stock market crash. Like a skilled captain navigating a ship through a storm, your calm wisdom will guide you towards safe shores. Keep learning, remain resilient, and let your financial wave ride with confidence!